Cryptocurrency tax reports for Self-Managed Super Funds.

Self-managed Super Funds are highly regulated, and require special attention to detail.

Cryptocate takes the complexity out of your SMSF’s cryptocurrency compliance and delivers a simple experience year after year.

Our reports are audit proof, and include every detail of your SMSF activity to ensure you are compliant.

Get the reports you need.

Accurate, fully compliant EOFY reports for your SMSF.

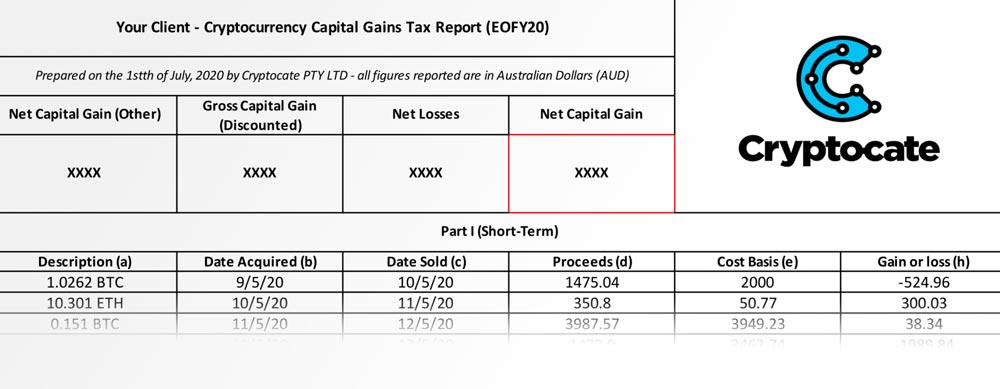

CGT Reports

Cryptocurrency Income Report

Closing Position Report

Complete Activity Report

Flexible services to suit your needs

Starter

$600

simple strategies.

Included hours

2

Volume

Suitable for accounts with < 1,000 transactions.

Data verification

1-on-1 assistance to verify the accuracy of your account’s data.

Primary reconciliation

Account reconciliation prioritised by tax impact.

Tax impact error analysis

In-depth error analysis measured by tax impact.

Professional

$1000

sophisticated strategies.

Included hours

4

Volume

Suitable for accounts with < 5,000 transactions.

Data verification

1-on-1 assistance to verify the accuracy of your account’s data.

Primary reconciliation

Account reconciliation prioritised by tax impact.

Tax impact error analysis

In-depth error analysis measured by tax impact.

Error fixing reconciliation

Reconciliation of account errors identified in Tax Impact Error Analysis.

DeFi reconciliation

Coverage for all kinds of DeFi activity.

Straightforward, readable reports.

How we work.

Our process covers the detail of your activity, so you can feel confident in your submission.

Free introductory discussion and custom proposal

Assisted data collection process

Review and reconciliation of all taxable events

Delivery of comprehensive cryptocurrency reports

We work with your

accountant.

Cryptocate covers crypto, your accountant covers submission. We support your accountant and handle all crypto-complexity.

5 reasons to

work with us.

Comprehensive

reports

Complete

transaction audit

All activity

types

Human

support

Works with

accountants

Our happy clients.