Have crypto trades to report?

Cryptocate has you covered.

Preparing Schedule 1 or Schedule D for your Form 1040 is our specialty.

Stress less this tax season.

Cryptocate takes the pressure off your crypto tax and does the hard work for your Form 1040 tax submission.

We specialise in the preparation of Schedule 1 and Schedule D, which is what you need for compliant crypto reports.

Our clients enjoy a reliable and accurate service stay ahead of cryptocurrency regulation and save tax dollars.

With support for any kind of transaction, you can invest with peace of mind.

Crypto tax for your Form 1040?

Our reports have what you need.

Our reports have what you need.

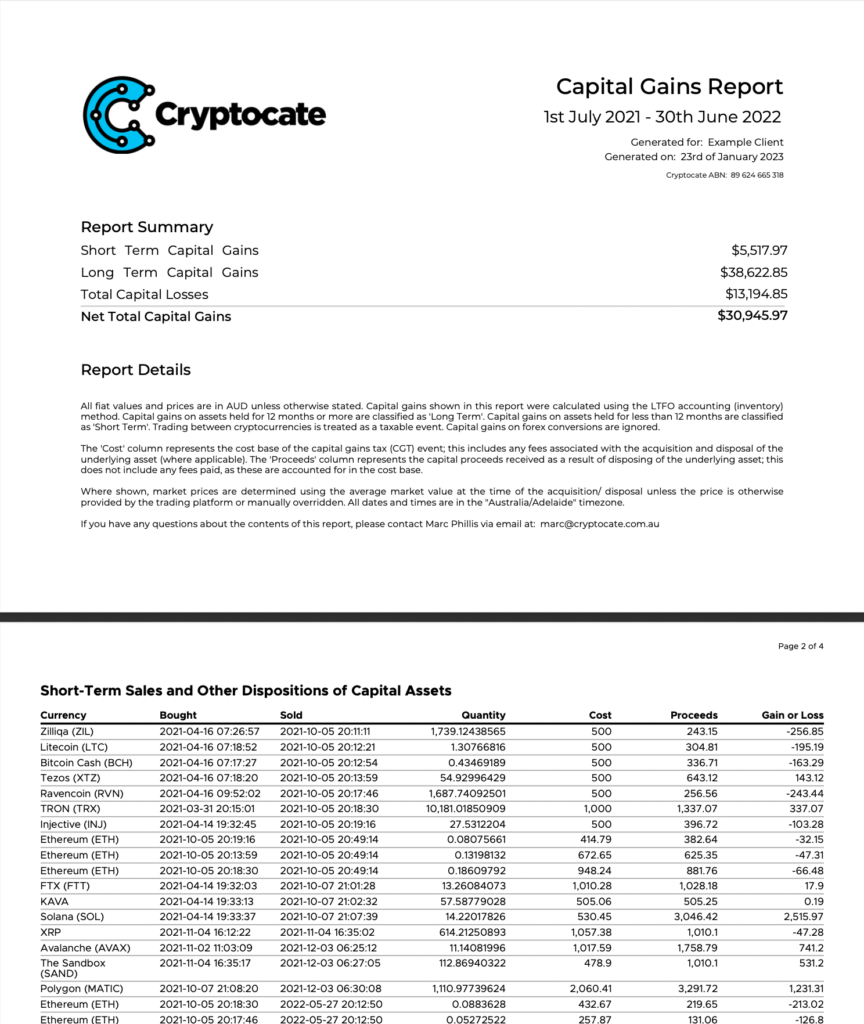

1040 Schedule D

A summary of all taxable disposals to accurately calculate your crypto gain or loss.

1040 Schedule 1

A summary of crypto income from interest earning activities, such as staking or lending.

Unrealised Gains Report

Flexible services to suit your needs

Basic

$275

Included hours

1

Volume

Suitable for accounts with any transactions.

Tax impact error analysis

In-depth error analysis measured by tax impact.

Starter

$1200

Included hours

6

Volume

Suitable for accounts with < 1,000 transactions.

Data verification

1-on-1 assistance to verify the accuracy of your account’s data.

Primary reconciliation

Account reconciliation up to allocated budget, prioritised by tax impact.

Tax impact error analysis

In-depth error analysis measured by tax impact.

Report delivery

The necessary documents you need to make a tax submission.

Professional

$2200

Included hours

11

Volume

Suitable for accounts with < 5,000 transactions.

Data verification

1-on-1 assistance to verify the accuracy of your account’s data.

Primary reconciliation

Account reconciliation up to allocated budget, prioritised by tax impact.

Tax impact error analysis

In-depth error analysis measured by tax impact.

Error fixing reconciliation

Reconciliation of account errors identified in Tax Impact Error Analysis.

DeFi reconciliation

Coverage for all kinds of DeFi activity.

Report delivery

The necessary documents you need to make a tax submission.

Straightforward, readable reports.

5 Steps to Compliance

Our process covers every single transaction, so no fee goes unclaimed or asset unaccounted for, which gives you the confidence you need.

Custom proposal to suit your needs

Receive a proposal tailored to your unique circumstances.

Assisted data collection and verification

Feel supported as we verify your activity is accounted for.

Initial reconciliation and review of your transactions

We account for all cryptocurrency activity and volumes.

Error analysis

We resolve any remaining errors to ensure accurate reports.

Delivery of highly accurate crypto tax reports

We deliver your precise report ready for lodgement.

We work with your

accountant.

Cryptocate covers crypto, your accountant covers submission. We support your accountant and handle all crypto-complexity.

Do you have complex crypto activity?

Our crypto tax reports support cryptocurrency transactions of any kind and volume.

5 reasons to

work with us.

Simple process

Accurate reports

All activity types

Secure

Human support

Our happy clients.