Cryptocurrency Tax Reporting Service for Accountants

Work with industry leading crypto-experts to support your clients.

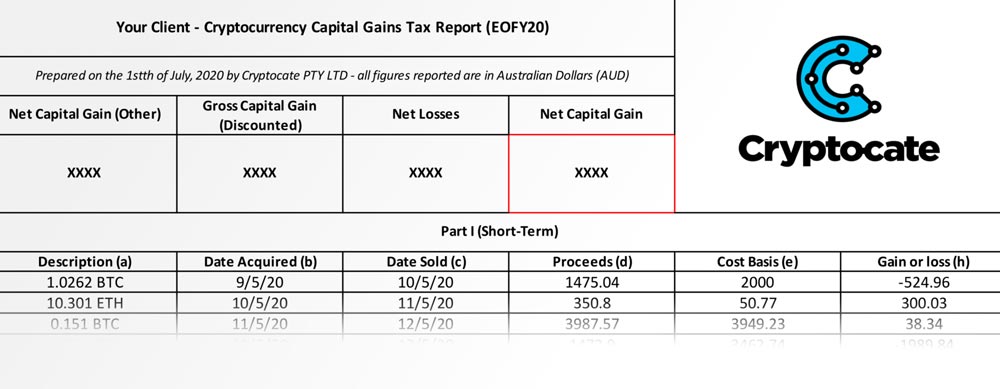

We prepare and deliver your client's cryptocurrency reports

At Cryptocate, we recognise how challenging it can be for accountants to keep track of cryptocurrency’s notoriously complex transactions and keep abreast of this ever-evolving industry. That’s why we’re here to help accountants climb out of the crypto maze! You can rely on our knowledge to provide accurate, up-to-date tax reporting that helps you ensure your customers’ cryptocurrency tax obligations are met promptly, professionally, and with full compliance.

If you’re an accountant that uses CoinTracking, CryptoTaxCalculator, or Koinly but lacks the key knowledge needed to finalise your client’s account, Cryptocate can help. We have experience with the leading crypto tax softwares and help accountants with their cryptocurrency reconciliation all across the world.

Do your client’s cryptocurrency tax returns leave you scratching your head?

Partner with Cryptocate today and take the stress and confusion out of cryptocurrency tax reporting.

Work with us.

Our simple workflow provides an excellent experience for your clients.

Client completes a custom form

They receive a custom proposal

Client data is validated and reviewed

We reconcile all transactions

Reports are delivered directly to you

Expert assistance with crypto tax preparation for accountants.

Our cryptocurrency tax reporting service for accountants provides expert assistance with crypto tax preparation, ensuring accurate and efficient reporting of all types of cryptocurrency activities.

Contact us today to simplify your crypto tax preparation process and ensure accurate reporting for your clients. Cryptocate takes the complexity out of crypto tax for you and your clients, which leaves you to focus on what you do best.

Don’t get left behind. Stay updated and compliant with Cryptocate.

Cryptocurrency has boomed in popularity, and over 25% of Australians now own some. This means increased compliance requirements for your clients, and additional complexity in their tax.

Cryptocate handles all cryptocurrency-complexity and supports you to service your clients.

Flexible services to suit your needs

Investor packages

$500

Data Verification

1-on-1 assistance to verify and collect your client’s data.

Tax Error Analysis

In-depth error analysis of their account to identify errors by tax impact.

DeFi Coverage

DeFi reconciliation included for

Pro packages.

Report Delivery

CGT and Income reports for

your clients.

SMSF packages

$600

with crypto.

Data verification

1-on-1 assistance to verify and collect your client’s data.

Tax Error Analysis

In-depth error analysis of their account to identify errors by tax impact.

Balance reconciliation

Account reconciliation prioritised by tax impact.

Covers DeFi

Coverage for all kinds of

DeFi activity.

Report Delivery

CGT, Closing Positions, and Activity Summary reports for full compliance.

Pro Trader reports

$800

Data verification

1-on-1 assistance to verify and collect your client’s data.

Tax Error Analysis

In-depth error analysis of their account to identify errors by tax impact.

High-volume reconciliation

Account reconciliation for

all volumes.

DeFi reconciliation

Coverage for all kinds of

DeFi activity.

Report Delivery

Gross Profit reporting

for traders.

Clear reports, easy submissions.

Have you explored DeFi?

We support custom integrations of new data sets, so no matter what kind of activity you have, Cryptocate can help.

We do crypto, you do tax. That’s synergy.

At Cryptocate we specialise in cryptocurrency so you can focus on what you do best.

5 reasons to

work with us.

Simple

workflow

Accurate

reports

Support

all activity

Secure &

confidential

Crypto-experts

Frequently Asked Questions.

Our happy clients.