Trading crypto like a pro?

Let us handle the compliance, so you can focus on what you do best.

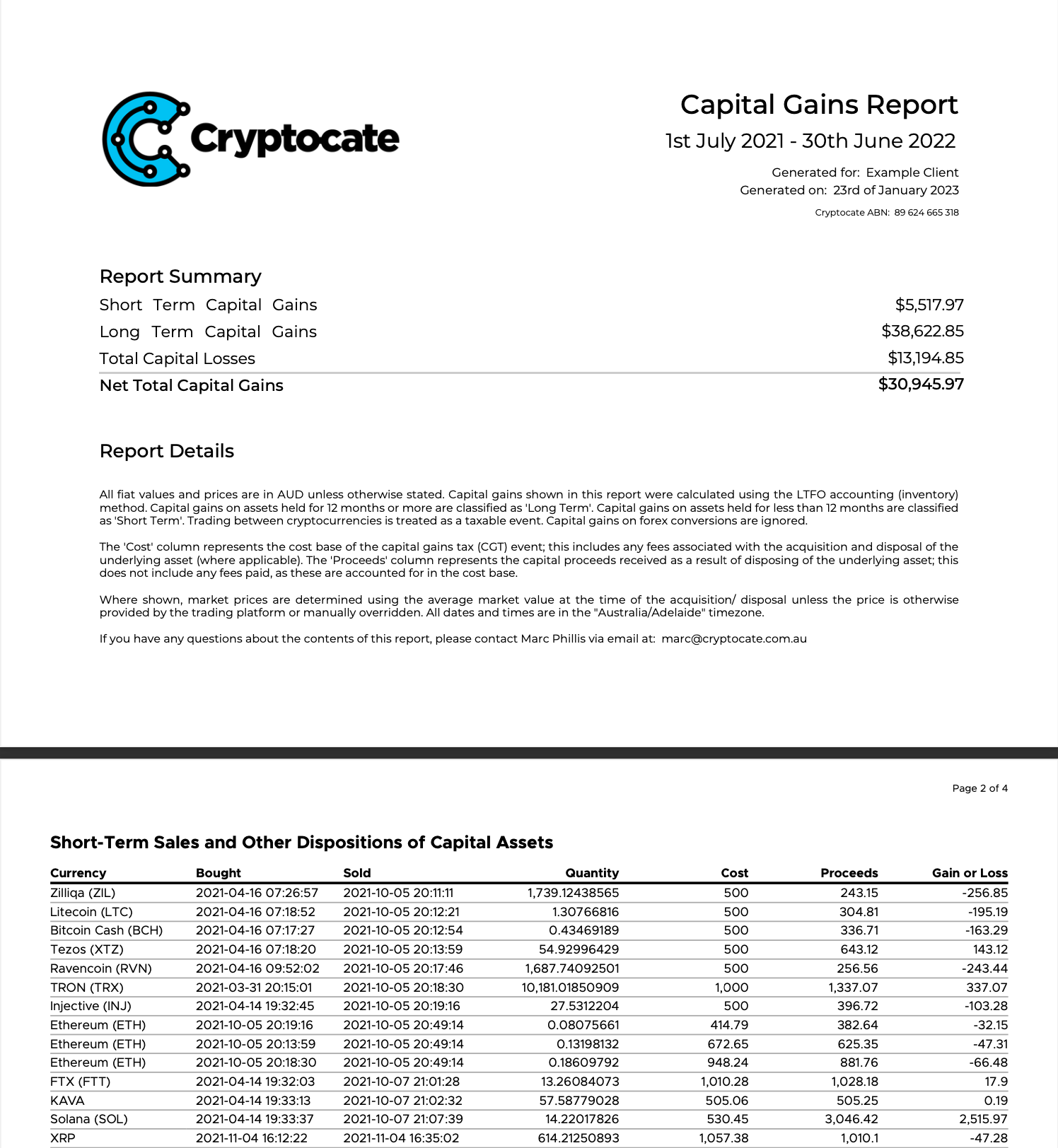

Our crypto tax reports for traders are the best in the business.

Trade with confidence.

Trade with confidence.

Crypto moves fast, and compliance takes away valuable time that could be spent researching the next opportunity.

Cryptocate has the expertise to support you in your trading business with the financial reports you need.

Our reports provide you with additional insights into your trading strategy, and can be prepared on a regular basis.

Focus on trading, we’ll handle the compliance.

Want financial visibility? You got it.

Gross Profit Report

A consolidated summary of your trading profit and loss, to see how much you're in the green.

Crypto Interest Report

Closing Position Report

EOFY asset valuation and closing balance statements, so you know where you stand.

Flexible services to suit your needs

Starter

$1200

Support for traders trading longer intervals.

Included hours

6

Volume

Suitable for accounts with < 500 transactions.

Data verification

1-on-1 assistance to verify the accuracy of your account’s data.

Transaction categorisation

Account reconciliation to ensure your transactions are treated correctly.

Tax impact error analysis

In-depth error analysis measured by tax impact.

Error fixing reconciliation

Reconciliation of account errors identified in Tax Impact Error Analysis.

Balance Reconciliation

Reconciliation of account balances to ensure every transaction is accounted for.

Professional

$2200

Reconciliation for higher volume strategies and DeFi.

Included hours

11

Volume

Suitable for accounts with < 1,000 transactions.

Data verification

1-on-1 assistance to verify the accuracy of your account’s data.

Transaction categorisation

Account reconciliation to ensure your transactions are treated correctly.

Tax impact error analysis

In-depth error analysis measured by tax impact.

Error fixing reconciliation

Reconciliation of account errors identified in Tax Impact Error Analysis.

Balance Reconciliation

Reconciliation of account balances to ensure every transaction is accounted for.

DeFi reconciliation

Coverage for all kinds of DeFi activity.

High Volume

$3200

Included hours

16

Volume

Suitable for accounts with > 1,000 transactions.

Data verification

1-on-1 assistance to verify the accuracy of your account’s data.

Transaction categorisation

Account reconciliation to ensure your transactions are treated correctly.

Tax impact error analysis

In-depth error analysis measured by tax impact.

Error fixing reconciliation

Reconciliation of account errors identified in Tax Impact Error Analysis.

Balance Reconciliation

Reconciliation of account balances to ensure every transaction is accounted for.

DeFi reconciliation

Coverage for all kinds of DeFi activity.

High-Volume Reconciliation

Targeted reconciliation of high-volume data sets.

Straightforward, readable reports.

Have you explored DeFi?

We support custom integrations of new data sets, so no matter what kind of activity you have, Cryptocate can help.

We work with your

accountant.

Cryptocate covers crypto, your accountant covers submission. We support your accountant and handle all crypto-complexity.

5 Steps to Compliance

Our process covers every single transaction, so no fee goes unclaimed or asset unaccounted for, to give you the confidence you need.

Free introductory discussion and custom proposal

Receive a proposal tailored to your unique circumstances.

Assisted data collection process

Feel supported as we verify your activity is accounted for.

Transaction categorisation

We account for all cryptocurrency activity and volumes.

Error analysis and reconciliation

We resolve any errors to ensure accurate reports.

Delivery of highly accurate crypto tax reports

5 reasons to

work with us.

Accurate reports

Any volume

Timely report delivery

Secure

Human support

Our happy clients.